Why API Discovery is Important for Financial Companies

Discover the role of APIs in the financial sector, and how API discovery ensures security, compliance, and efficiency in financial services.

Technology and finance have a symbiotic relationship, with technology acting as the main driver of innovation and customer satisfaction. Application Programming Interfaces (APIs) are essential in the digitalization of the finance sector, allowing for seamless integration between services, enhancing customer experiences, and fostering financial inclusion. However, as the reliance on APIs grows, so does the complexity of managing them. This is where API discovery comes into play, acting as a tool for financial companies to maintain security, compliance, and operational efficiency. But why exactly is this tool so vital for the financial industry?

The Role of APIs in Financial Companies

APIs exist in almost all modern financial services. They facilitate everything from mobile banking apps and online payment gateways to complex investment platforms and insurance solutions. APIs allow different software systems to communicate and share data, enabling financial institutions to integrate third-party services, streamline operations, and offer personalized experiences to their customers. Most likely, if you are a financial service existing in the modern world, you use APIs.

For instance, APIs enable banks to connect with payment processors, integrate with customer relationship management (CRM) systems, and provide real-time financial data to users through mobile applications. In investment and trading, APIs allow for the integration of market data feeds and trading platforms, providing traders with real-time information and execution capabilities. The insurance industry uses APIs to streamline claims processing, underwriting, and policy management.

APIs are especially becoming a prominent topic for those in charge of the security of financial companies. A notable example would be the fact that established banks have recently increasingly outsourced their software development and services. This trend, accelerated by the pandemic, has led to a dependency on third-party service providers, usually with less-than-ideal security protocols when it comes to APIs.

The Challenges of API Management

Despite their advantages, APIs present several management challenges, especially in the highly regulated financial sector. One of the main issues is the proliferation of undocumented or "shadow" APIs, which can lead to significant security vulnerabilities. Without proper visibility, these APIs can become entry points for cyber-attacks, potentially exposing financial data. Visibility includes documentation, but also knowledge of the owners of various APIs within an organization.

Transparent view on what is actually being used on the product side is important. And what is all in there? I think this really helps in protecting that way, way more. - Max Imbiel, CISO at Bitpanda

Moreover, the lack of a comprehensive API inventory can result in inefficient resource allocation, where redundant or outdated APIs continue to consume valuable resources. Financial companies also face the challenge of maintaining compliance with various regulatory standards, such as the Payment Card Industry Data Security Standard (PCI DSS), which requires stringent security measures for APIs handling cardholder data, or the EU's PSD2, which aims to fix the jeopardizing of customers’ data, by reducing the unregulated information exchanges.

Importance of API Discovery

API discovery refers to the process of identifying and cataloging all APIs within an organization's ecosystem. This practice is crucial for several reasons:

- Improved Security and Compliance: By identifying all APIs, especially those handling sensitive data, financial institutions can ensure that appropriate security measures are in place. This reduces the risk of data breaches and helps in maintaining compliance with the strict regulatory frameworks that financial institutions operate under such as PCI DSS, GDPR, and others.

- Enhanced Operational Efficiency: A well-maintained API inventory allows financial companies to manage their APIs more effectively, reducing redundancy and optimizing resource usage. This leads to cost savings and better allocation of IT resources since cataloging APIs allows organizations to identify and eliminate redundant the redundant ones.

- Better Resource Management: With a clear understanding of the APIs in use, financial companies can decommission outdated or unnecessary APIs. This streamlines operations by reducing potential points of failure. Also, by having an updated inventory, organizations can plan better for future integrations and development, ensuring that new APIs align with existing ones and contribute to a cohesive system architecture.

API Security and PCI Compliance

API security is paramount in the financial sector, where the stakes are incredibly high.

Ensuring that APIs comply with PCI DSS, for example, involves several key steps, which are significantly facilitated by robust API discovery processes:

- Identifying APIs Handling Cardholder Data: The first step in achieving PCI compliance is to identify all APIs that process, store, or transmit cardholder data. API discovery tools can automate this process, providing a comprehensive inventory of relevant APIs.

- Ensuring Secure Communication and Access Controls: APIs must use secure communication protocols, such as HTTPS, and implement strong access controls to prevent unauthorized access. Regular API discovery helps in identifying APIs that may not meet these security requirements.

- Monitoring and Auditing API Activity: Continuous monitoring and auditing of API activity are crucial for detecting and responding to security incidents. API discovery tools can provide real-time visibility into API usage patterns, helping to identify and mitigate potential threats.

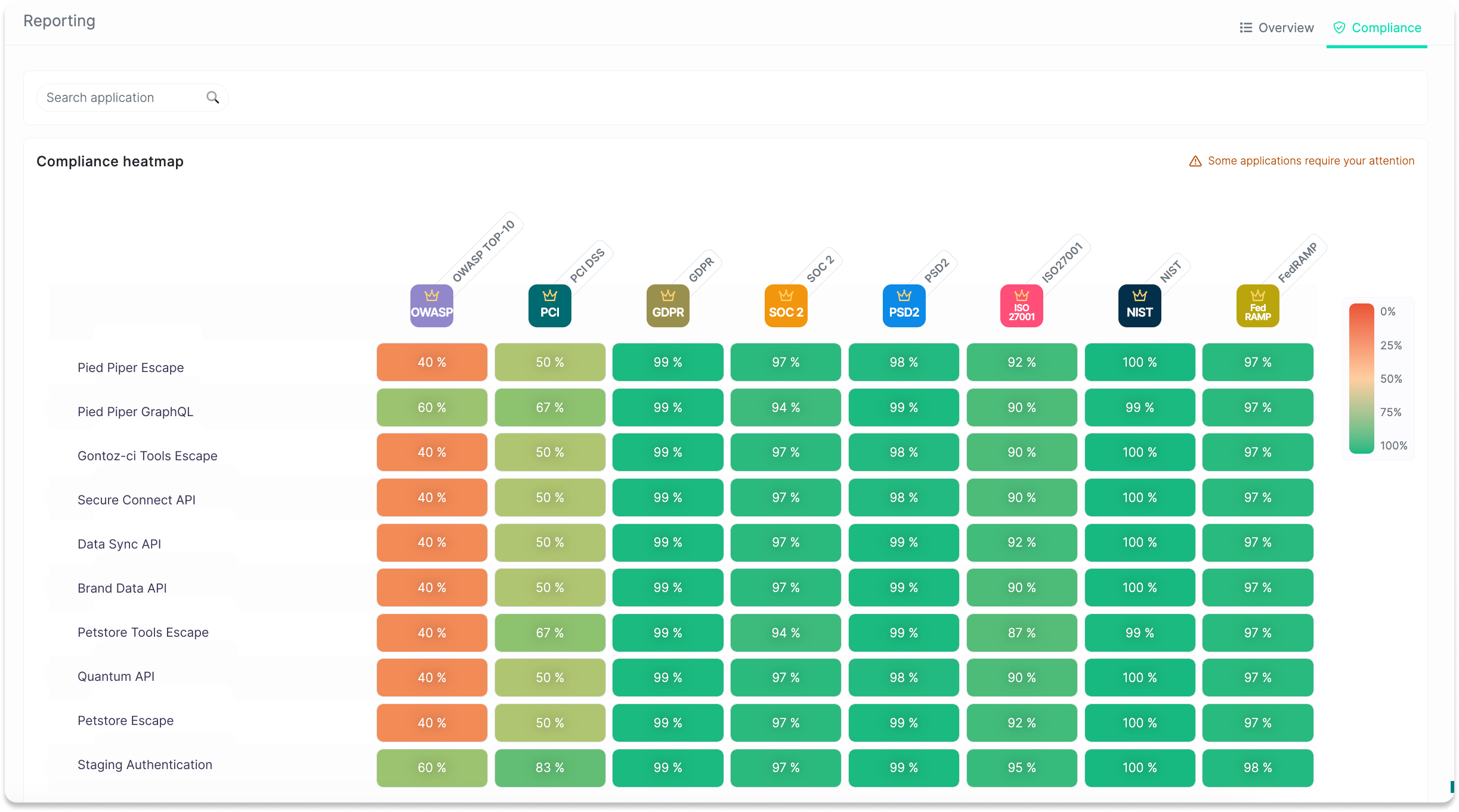

In general, it is very important to know how compliant you are with different regulations that affect your industry. At Escape, we do that by automatically calculating your compliance posture using a visually expressive matrix.

Agentless API Discovery: A Game-Changer

Traditional API discovery methods often require the installation of agents, which can be cumbersome and resource-intensive. However, the advent of agentless API discovery has revolutionized this process.

Agentless API discovery offers several advantages:

- Ease of Deployment: Without the need for installing agents on every server or application, deployment becomes significantly easier and faster.

- Reduced Overhead: Agentless solutions minimize the operational overhead, making it easier for financial companies to maintain a comprehensive API inventory.

- Comprehensive Visibility: These solutions provide a holistic view of the API landscape in a database or a lifecycle graph format, identifying both documented and undocumented APIs seamlessly.

Learn more about how you can implement agentless API discovery with Escape

Get a complete inventory of your APIs, enrich it with integrations with modern tools like Wiz and get a full context with API Graph representation

Get a demoThis agentless approach allows for immediate identification of rogue APIs, which could pose significant security risks if left unmanaged. The ease of use and comprehensive coverage make agentless API discovery an invaluable tool for financial companies striving for robust API management.

Case Studies and Real-world Applications

Several financial institutions have successfully implemented API discovery solutions, reaping significant benefits in terms of security, compliance, and efficiency. For example, Sungage Financial implemented Escape's solution of API Discovery to ensure API Security at every development stage and to implement shift left with continuous security. This allowed them to fix business-critical issues within just 1 week of starting to use the platform which not only enhanced their security posture but also boosted customer confidence.

Another good example would be Lightspeed, a payment technology that partners with more than 160,000 global retail and hospitality businesses. They used Escape's features for continuous API discovery, simplified compliance management and to get insights for remediation. In this case, Lightspeed was able to swiftly secure its payment platform. By gaining comprehensive visibility into their API ecosystem, they now had an extensive overview of their application ecosystem, empowering them to enhance control over its attack surface and make informed security decisions across numerous APIs.

Conclusion

As the financial sector continues to evolve, the importance of API discovery will also grow. For financial companies, knowing exactly where your APIs are and what they’re doing is crucial for keeping your data secure, staying compliant, and running smoothly.

By focusing on solid API discovery, financial institutions can:

- Spot potential risks before they turn into real issues

- Improve efficiency by getting a clear view of how systems interact

- Stay flexible and ready to adjust to new rules and market changes

At the end of the day, financial companies that take API discovery seriously are the ones that will stay ahead—keeping their operations secure, compliant, and ready for whatever’s next.

If you're not already prioritizing API discovery, now’s the time to start!

💡Want to learn more? Discover the following articles: